-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Harmonic patterns

This is one of the harder topics, but if you are persistent enough to learn this type of analysis, the result would pay for the effort. The aim of this method is to recognize specific markets structures called “harmonic patterns” and generate trade ideas with their help.

Harmonic patterns were discovered by H.M. Gartley in 1932. Later the theory was developed by Larry Pesavento, who wrote a book Fibonacci Ratios with Pattern Recognition.

Harmonic patterns are similar to chart patterns like “Head and shoulders” in a sense that they are based on a specific shape of price action. However, harmonic patterns have something special about them: they are based on the use of Fibonacci tools (retracements and expansions). Such a combination allows these patterns to produce accurate and reliable trade signals. The main idea is to identify the levels at which the general trend will resume after a correction as well as this trend’s targets.

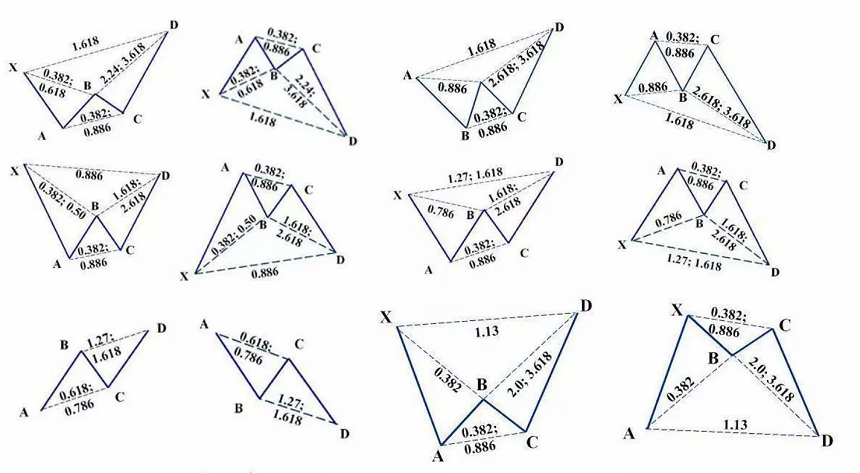

There are many different harmonic patterns: ABCD, Butterfly, Gartley, Shark, Crab, Bat, etc. These patterns can be either bullish or bearish. Many patterns may look rather similar to each other but have some distinctions. The art of harmonic trading is the ability to differentiate between these patterns. Technical analysis assumes that history repeats itself. As a result, the idea is that these patterns will occur in the future and will have the same effect as they did in the past.

The schemes of various harmonic patterns

We will explain how to trade each pattern in the further articles.

The main advantage of harmonic patterns is that you won’t need to make guesses because you can rely on specific Fibonacci numbers.

The numbers used in harmonic patterns are either directly or indirectly derived from the 0.618 and 1.618 ratios of the Fibonacci sequence. These derived numbers include 0.786, 0.886, 1.13, and 1.27. There are also many complimentary numbers: 0.382, 0.50, 0.707, 1.41, 2.0, 2.24, 2.618, 3.14, and 3.618. These numbers validate harmonic patterns and determine areas of potential changes in the price.

How to trade using harmonic patterns?

To achieve positive results using harmonic patterns, you will need to:

- Remember what different harmonic patterns look like.

- Recognize these patterns on the price chart.

- Use Fibonacci tools correctly.

- Know how to find the targets of harmonic patterns.

The closer is a harmonic pattern seen on the chart to the proportions described for this pattern in textbooks, the higher the probability that it will produce a good trade signal. Notice that it’s necessary to wait until the pattern is formed before trading on its signal.

2023-11-21 • Updated

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic Trading: What Is It?

- Fibonacci Ratios and Impulse Waves

- Guidelines of Alternation

- What is a triangle?

- Double Three and Triple Three patterns

- Double Zigzag

- Zig Zag and Flat Patterns in Trading

- Advanced techniques of position sizing

- Truncation in the Elliott Wave Theory

- Ichimoku

- What is an extension?

- Ending Diagonal Pattern

- How to trade gaps

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Butterfly

- Crab Pattern

- Bat

- Gartley

- ABCD Pattern

- What is an impulse wave?

- Motive and corrective waves. Wave degrees

- Introduction to the Elliott Wave Theory

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences