Struggling to choose between part-time and full-time trading? Then this article is for you!

2023-04-03 • Updated

Currencies, gold or indices… What to trade first?

You’ve already learned how to use some trading tools and strategies and when to enter/exit the market. However, you might be confused what asset to choose for trading at first. This article will help you to find out which trade instrument is best for you! Jump in!

First, we can roughly divide all financial assets into two groups: safe-haven and risky. As a rule, safe-haven assets tend to rise in times of economic uncertainty and instability. In this case, traders usually say something like: “market sentiment is risk-off” or “risk-aversion prevails in the market”. When this happens, investors usually look for the safest places to park their capital. Therefore, they favor safe-haven assets such as precious metals: gold, silver, platinum, and the most trusted currencies: the US dollar (USD), the Japanese yen (JPY), and the Swiss Franc (CHF). Why this happens? Precious metals have a long history and traders believe that they will retain their high value in the future. The JPY and the CHF are considered reliable due to the stable financial positions of Japan and Switzerland. The USD is an occasional safe haven due to the strength of the US economy.

Let’s move on to risky assets. They are the Australian dollar, the New Zealand dollar, the British pound, oil, and stock indices such as S&P 500, NASDAQ, and Dow Jones. Investors favor riskier assets when economic indicators in advanced nations are exceeding expectations, key banks and organizations release optimistic forecasts and other good news lighten up everyone’s mood. When things like that happen, traders and investors want to make money work, so they pursue higher yields and, as we know, higher yields always go hand in hand with higher risks, that’s why they buy higher-yielding riskier assets.

Well, it’s clear what currencies are, but what are indices like? Let’s figure it out. Indices are baskets of individual stocks, which are often ranked by independent institutions like major banks or financial companies. The most well-known stock index is S&P 500. It includes stocks of 500 large US companies. This index reveals the performance of the stock market by risks and revenues of these companies. Most traders use it as a barometer of market sentiment.

We call an asset a safe haven when it's not really risky and have low volatility. Although these assets can move drastically and create huge swings in price, they're usually steady and stable. The Japanese Yen could be an example of a safe haven asset before the economic crisis of 2022. The Bank of Japan's government decided not to support the Yen and let it slide lower without any robust limitations. That's why a lot of investors are now less sure about the future of the JPY as a safe haven asset. The other one is the Swiss Franc (CHF) which is still a stable currency.

Notice, that safe haven assets are a double-edged sword as these instruments provide significantly fewer returns on your account. It is a hazard pay and we should accept it.

|

Assets |

|||||

|

Safe-haven |

Risky |

||||

|

Precious metals |

Credible currencies |

Stick indices & stocks |

Risk-on currencies |

Oil |

Cryptocurrencies |

|

Gold Silver Platinum |

USD JPY CHF |

S&P 500 NASDAQ Dow Jones |

AUD NZD GBP |

WTI Brent |

Bitcoin Ethereum Litecoin |

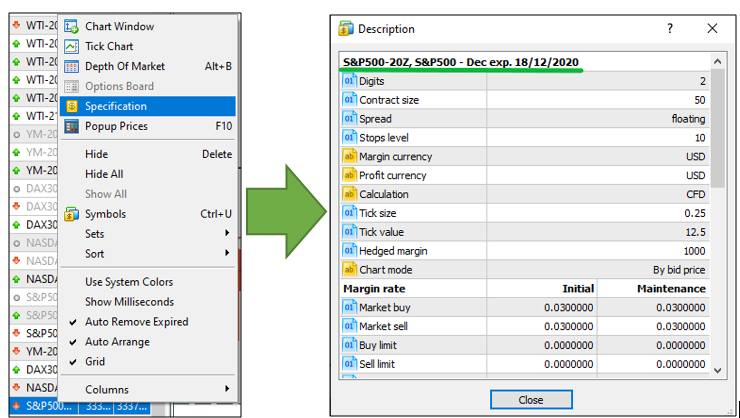

Here’s one thing you should remember: to trade indices mentioned above, you should choose contracts for difference (CFDs). For example, to trade the S&P 500 in September, you need to pick a CFD, which is named S&P 500-20U. Notice that this contract will expire on September 18. Thus, to trade this stock index further starting from September 18, you will need to choose another CFD: S&P 500-20Z, which expires on December 12. So, its first trade may be done on September 8, and the last trade – on December 18. You can check the expiration dates in MetaTrader by clicking the right mouse button at the CFD in question and choosing ‘Specification’.

Now, you have the basic knowledge of financial assets on Forex. Let’s discuss some market rules that every trader should know.

It’s important to follow significant economic releases, speeches from the central banks and governments and others market events. Why? They tend to drive prices. For example, if the British GDP comes out better than the forecasts, the British pound (GBP) will rise. Otherwise, the GBP will fall. Be aware that it works generally in most of the cases, but still not always. Sometimes, the market reaction is quite modest. So, here’s another tip: catch the overall market movement and join the flow!

What’s interesting is that some assets are highly correlated due to their economies or locations, for instance, the AUD and the NZD when they are traded against the USD or the EUR. Moreover, it’s essential to understand the country’s economic background. The best example is the Canadian dollar. It is really sensitive to the oil prices. The CAD and oil prices usually move in the same directions as the Canadian economy is one of the largest oil producers. Also, Chinese and Australian economies are highly connected due to the countries’ active trade relations. Therefore, Chinese economic releases have a huge impact not only on the Chinese yuan, but also on the Australian dollar.

The Forex world is really huge and diversified. It’s so interesting to explore and analyze it. If you understand how everything is interconnected on Forex, it will give you greater confidence in trading!

Struggling to choose between part-time and full-time trading? Then this article is for you!

In trading, we can rely on a bunch of different entry signals.

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!