-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

What is Forex Trading?

Let’s explore the most dynamic and fast financial market and dive into the Forex trading basics, its decentralized nature, and how it operates around the clock. In this article, we’ll also highlight the major players in the Forex market and outline the role of brokers in providing access to this market.

What is Forex

Forex, FX, or Foreign Exchange is a global marketplace for buying and selling the currencies of different countries against each other. Forex is one of the largest global financial markets for trading various currencies.

Operating 24 hours a day, five days a week, the Forex market allows anyone around the globe to engage in currency trading at any time. In the modern age of electronic markets, physical presence at a currency exchange is unnecessary. Buying and selling currencies of a particular country against another country’s currency happens online. Traders open a specific currency position and expect the price to go up or down depending on the market situation. Traders can make a profit from these price movements.

There is no way to trade a currency unilaterally. Trading is a relative process – when someone buys, someone sells. Due to the difference between these transactions, some traders benefit, and others lose money.

How FX works

A key characteristic of the Forex market is its decentralized nature, meaning there is no single physical location for investors to trade currencies. Market participants, spread across the globe, connect via the internet to trade currencies. Major financial centers such as London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney play significant roles in the Foreign Exchange markets.

People who want to trade Forex can’t just start trading real currency pairs because this market is for big players: banks, governments, and financial institutions. To access the currency market, traders choose a Forex broker who connects them with international flows.

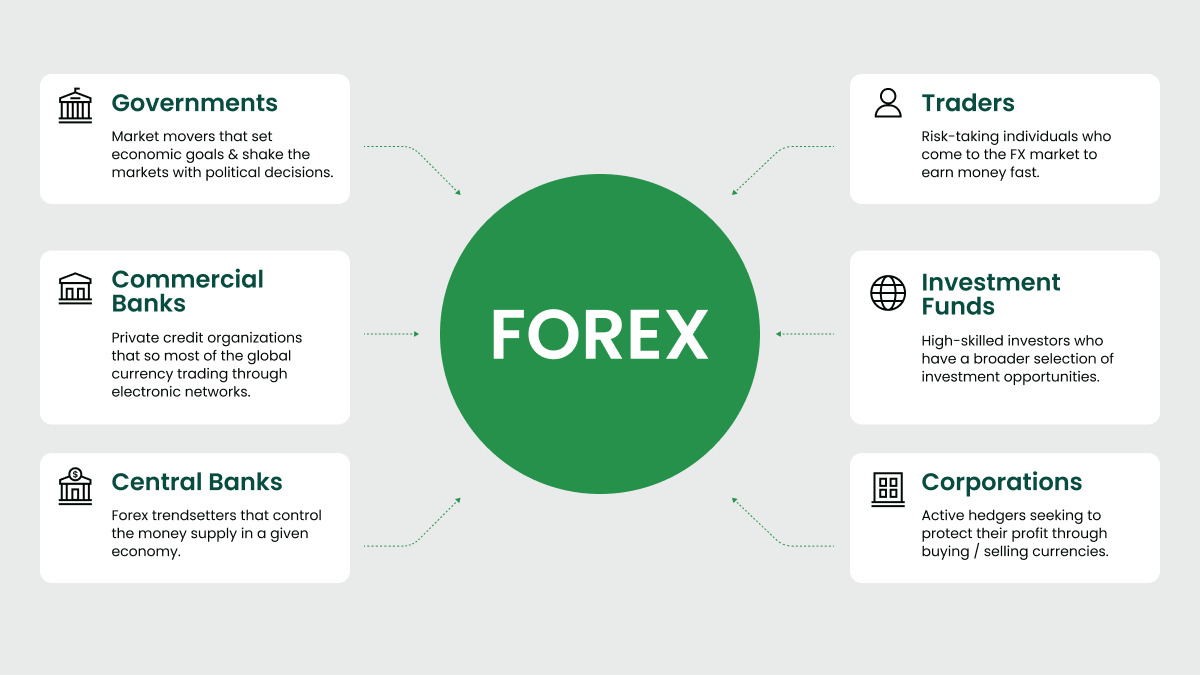

Major Forex players

Forex trading involves many people and organizations. Some of them trade to make profits. Others trade to hedge their risks. Moreover, some traders use foreign currencies to pay for needed goods and services. However, that’s a real-life example rather than the case for trading.

The leading FX players are the biggest banks like Citi, UBS, Barclays, Deutsche Bank, Goldman Sachs, and Bank of America. These and other banks, collectively known as the interbank market, manage many financial transactions daily.

Commercial giants like Apple, Facebook, and Microsoft also participate in Forex trading, engaging in activities that can influence currency exchange rates. However, the effect is usually weak.

Apart from banks and large commercial companies, constant Forex market participants are governments and central banks such as the ECB (European Central Bank), the BoE (Bank of England), and the US Federal Reserve. Governments and central banks play a crucial role in managing national currency reserves and influencing the Forex market through policy decisions and interest rate adjustments.

National governments participate in the Forex market to handle foreign exchange reserves and provide different trading operations. Central banks affect the market with their policy and statements. They can control inflation and use interest rates for this purpose.

In addition to numerous banks, multinational companies and governments, as well as many risk-seeking investors, are always ready to engage in different speculations.

It is best to concentrate on the real purpose of market trading and remain clear on what that is: the buying and selling of currencies with the intention of making a profit.

The typical retail trader is a risk taker. This group includes individuals who trade daily or weekly to earn as much money as possible. They study economic and political news, bank statements, statistical releases, and public announcements to predict potential future price movements.

Other traders prefer to rely on technical indicators and pay less attention to the news.

How to operate on Forex

A broker gives traders access to the Forex market. Brokers are the companies that connect people and the interbank market where all the trading processes happen. Any person can trade in the markets with the help of a Forex broker.

Brokers provide services for secure and safe trading and access to software programs where traders can see real-time currency quotes and place orders for buying or selling positions (currencies) in just a few clicks.

If you want to start a trading career, all you have to do is open an account with a Forex broker you like. FBS is a perfect choice for that role.

How to choose the right Forex broker

When choosing a broker, pay attention to these three primary parameters:

- Years of expertise

- Regulations

- Reputation

Why are these characteristics reliable? The answer is simple – all of them prove that a broker is trustworthy enough to provide financial services. Experience in the market means that a broker is qualified enough to organize the trading process with all its peculiarities. As for regulations, this parameter is aimed at making the workflow transparent and secure for the company and its clients. Licensed brokers guarantee protection for traders and their funds. Finally, reputation is responsible for the goodwill of the company and the general outlook. It asserts how friendly and supportive a broker is with the clients.

FBS is a licensed broker, providing high-quality services to its clients since 2009, and is widely recognized as one of the market leaders. The company has numerous international recognitions and awards. For more than 15 years of market expertise, the company has always been extremely customer-oriented. Despite its worldwide success, FBS meets the needs of every single trader. The team is always ready to help – the support chat is available 24/7.

FBS offers a range of educational materials to help you learn all about Forex trading. What is Forex trade all about? How to use MetaTrader platforms? What is the average risk-reward ratio? FBS reveals many other questions in their articles, video guides, social media, and more to educate traders and help them make informed decisions.

Last but not least, trading conditions are one of the key factors to consider when choosing a broker. Look at the executions, spreads, and commissions that a broker offers. Check whether there is a swap-free option.

FBS is famous for one of the fastest order executions from 0.01 sec, spreads from 0.7 pips, and a wide variety of trading instruments. We aim to give traders the best of Forex!

FAQ

What is Forex and how does it work?

The meaning of Forex, also referred to as foreign exchange, involves traders engaging in the exchange of one currency for another to benefit from these fluctuations. Unlike stock traders who deal in shares, Forex participants focus on maximizing their earnings through the careful timing of currency purchases and sales, aiming to capitalize on the varying exchange rates.

Is Forex easy for beginners?

For beginners in Forex trading, navigating through the extensive information available can be indeed challenging. The easiest way to start trading is to master the basics, understand the software, and experiment with demo accounts. Additionally, immersing in the global economic context and staying updated with financial news can provide deeper insights into market movements. Building a network with other traders and participating in Forex communities can also offer valuable support and knowledge sharing.

How to explain Forex for beginners?

The Forex market is a marketplace for exchanging currencies. Its worldwide reach, comments, and finance makes FX the world’s largest and most liquid market. Currencies are traded in pairs against each other.

What is the first rule of Forex?

The first rule of Forex trading is to have a trading plan. Plan your trades in advance, specifying entry and exit points, and implement risk management strategies. When planning a trade, it’s also essential to set stop-loss orders to limit potential losses and take-profit orders to eliminate the impact of emotions on your trade.

Summary

In conclusion, Forex trading offers a unique opportunity for individuals to participate in the dynamic world of currency exchange, from understanding the basics of how the market operates to navigating through the complex landscape of international finance.

As we’ve explored the roles of major players in the market, from banks to individual traders, it’s clear that Forex trading is not just about currency exchange but also about understanding global economic dynamics.

Whether you’re a beginner learning the ropes through demo accounts or a seasoned trader analyzing the global economic landscape, the journey into Forex trading is about continuous learning and adaptation.

With the right broker providing access to trading platforms and market insights, traders are well-equipped to navigate the Forex market. At FBS, you can start by learning the Forex basics and experimenting with demo accounts.

This tutorial gives you central points of Forex and foreign exchange. Please check out the next course and improve your trading skills.

2024-04-09 • Updated

Other articles in this section

- How to Start Forex Trading?

- How to Make Money on Forex

- Economic Calendar: How to Read and Use

- How to open and close a trade in MetaTrader?

- How Much Do You Need to Start Trading Forex

- Forex Demo Account

- How to determine position size?

- Leverage and Margin: How Can You Use Them in Forex Trading?

- What Are Rollover and Swap and How to Use Them When Trading?

- Types of Trading Orders: Market, Limit, Stop, Trailing Stop, Stop-Limit

- When is the Forex Market Open?

- What Are Bid, Ask, and Spread?

- Calculating profits

- What are Lots, Points, and Leverage

- How to trade?

- Currency Pairs in Forex Trading

- What Software Do You Need for Trading?

- The Advantages and Risks of Trading Forex