The Best Place to Invest Money in 2024

Smart Ways to Invest Your Money in 2024

In a world where economic tides sway and groundbreaking innovations shape our future, the investment landscape demands a new breed of savvy investors. Gone are the days of rigid strategies and outdated methodologies. It is time to embrace a more dynamic, flexible, and informed approach to make your money thrive.

Tech innovation with its ongoing advances in artificial intelligence, machine learning, and cybersecurity, drives growth. Renewable energy and real estate offer exciting investment opportunities. High-potential markets like cryptocurrencies and ETFs are emerging. So, what is the best place to invest money in 2024? Keep reading to find where to invest money this year.

Where to invest money right now

The beginning of the year always brings investors multiple choices and opportunities. Technological advancements have evolved rapidly over the last decade and keep expanding, affecting markets significantly. If you have enough money to invest, consider the following companies.

Nvidia Corporation

Companies like Nvidia have emerged as frontrunners in technology, particularly in AI and cybersecurity. Nvidia, known for its cutting-edge AI and graphics processing technologies, has carved out a significant niche in sectors ranging from gaming to autonomous vehicles. This makes it an attractive option for investors keen on tapping into the future trajectory of the tech industry.

Alibaba Group

In the burgeoning markets of Asia, e-commerce stands out as a sector with tremendous growth potential. Alibaba Group, a giant in China's e-commerce market, has also expanded into cloud computing and AI. Its diverse portfolio and dominance in the Asian market present an enticing opportunity for investors eyeing the explosive growth of emerging markets.

Crypto

Regarding investment strategies, there is a marked difference between short-term and long-term approaches. Cryptocurrencies like Bitcoin offer short-term investors an exciting, albeit risky, avenue. Despite their volatility, the growing acceptance of digital currencies in transactions and investment portfolios cannot be ignored. So, cryptocurrency is for sure the best way to invest.

Apple Inc.

Geographically, investment opportunities vary. In North America, tech giants like Apple provide a mix of stability and potential growth. Apple's continued innovation and dominance in consumer electronics make it a solid choice for investors. Europe's focus on green energy solutions opens up prospects for companies like Siemens, a leader in energy solutions.

Oil and gas

In Asia, infrastructure development is critical. Companies like Reliance Industries in India, with their operations spanning oil and natural gas, offer an insight into the region's rapid economic growth and infrastructure development.

Considering investing in stocks?

Stock market trends always look alluring. However, the stock market is expected to face challenging macroeconomic conditions in 2024. J.P. Morgan Research forecasts only moderate global economic growth with an expected end to the worldwide expansion by mid-2025. Factors such as persistent inflation and geopolitical risks are expected to keep rates higher for longer, impacting equity performance. However, slowing global growth could be counterbalanced by factors such as China's re-engagement, massive fiscal stimulus in the US and Europe, and the residual strength of US consumers stabilizing growth in 2023.

If one wants to pay attention to the stock market (or not), there are three prime examples: the US500, Google, and Bitcoin.

US500

In the broader economic landscape context, stock markets, particularly indices such as the US500, are anticipated to exhibit fluctuations.

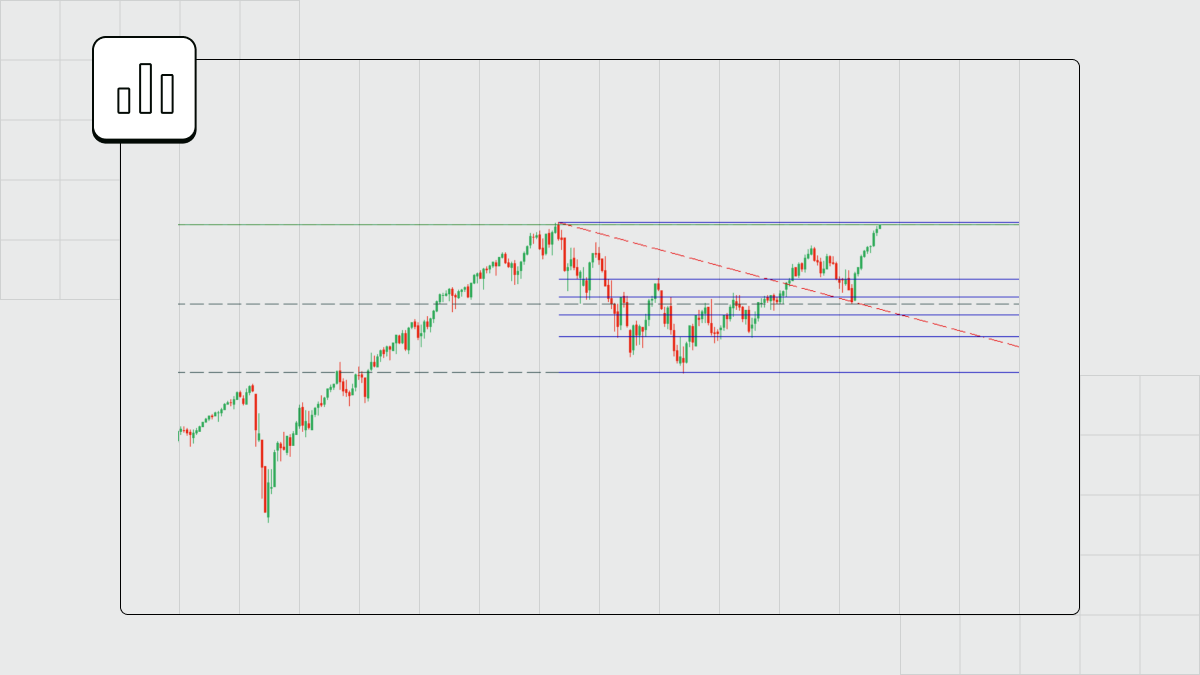

US500 Weekly Chart – End of 2023

The US500 is projected to reach the record 4800 mark very soon. If the index remains stable above 4800 for an extended period, it could target a future milestone 5600 by the end of 2024, coinciding with the Fibonacci 161.8 level. However, the risk of a US recession in 2024, which has an estimated 60-70% probability of occurring, could lead the Federal Reserve to cut interest rates to 1.5-2.0%. Such rapid rate cuts have historically led to significant declines in high-risk assets. This means the US500 could fall as low as 4100 and 3550 next year.

Investing in the US500 provides broad market exposure and diversification as it represents the 500 largest U.S. companies from various sectors that have historically delivered consistent long-term growth.

Investing in big tech giants such as Google is equally fascinating.

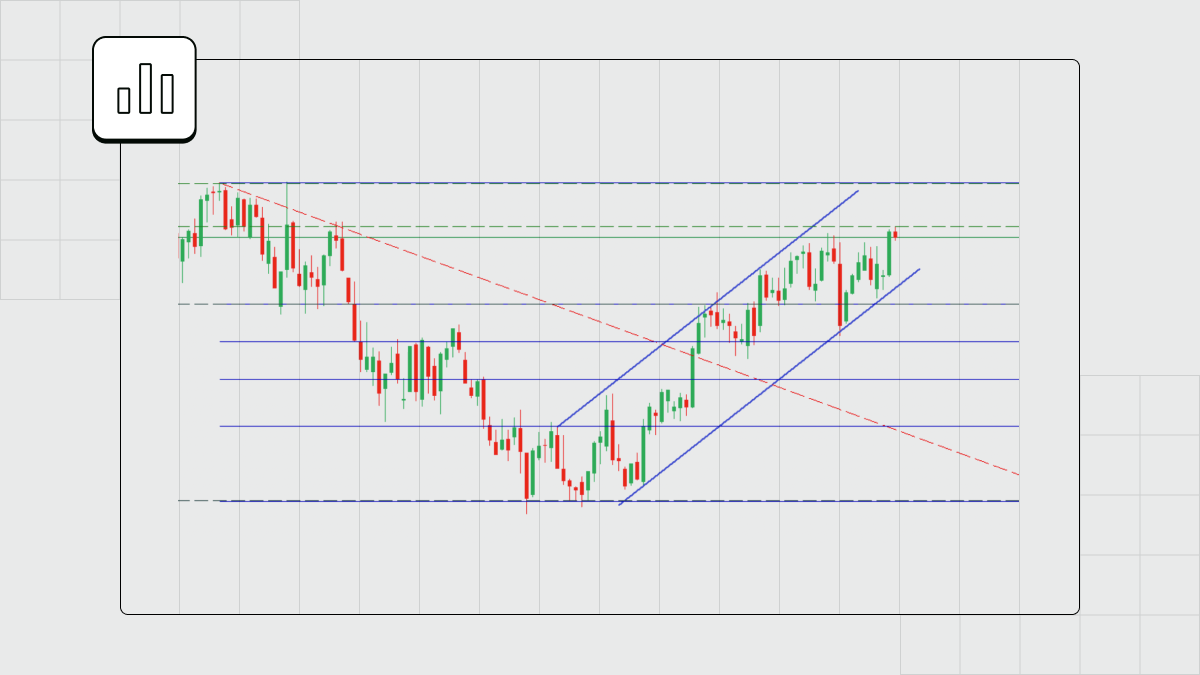

Google Weekly Chart – End of 2023

The weekly chart of Alphabet Inc. (Google) stock is trending bullish, with the price well above the 61.8% Fibonacci level at 126.60. The trend lines indicate a sustained uptrend, forming a bullish channel. If the upward momentum continues, the next significant Fibonacci level would be 100 percent, potentially at $151.50.

However, a critical antitrust lawsuit has begun against Alphabet, Google's parent company and its outcome could have significant implications for the company's business practices and market dominance. The legal battle is expected to be protracted and closely watched as it could lead to changes in Google's operations and regulation, affecting investor sentiment and stock price.

But despite some of the company's struggles, investors are confident of continued growth and consider Google the best way to invest.

Bitcoin

Do not want to consider stocks and are thinking of investing in alternative assets? Well, it is time to invest in Bitcoin.

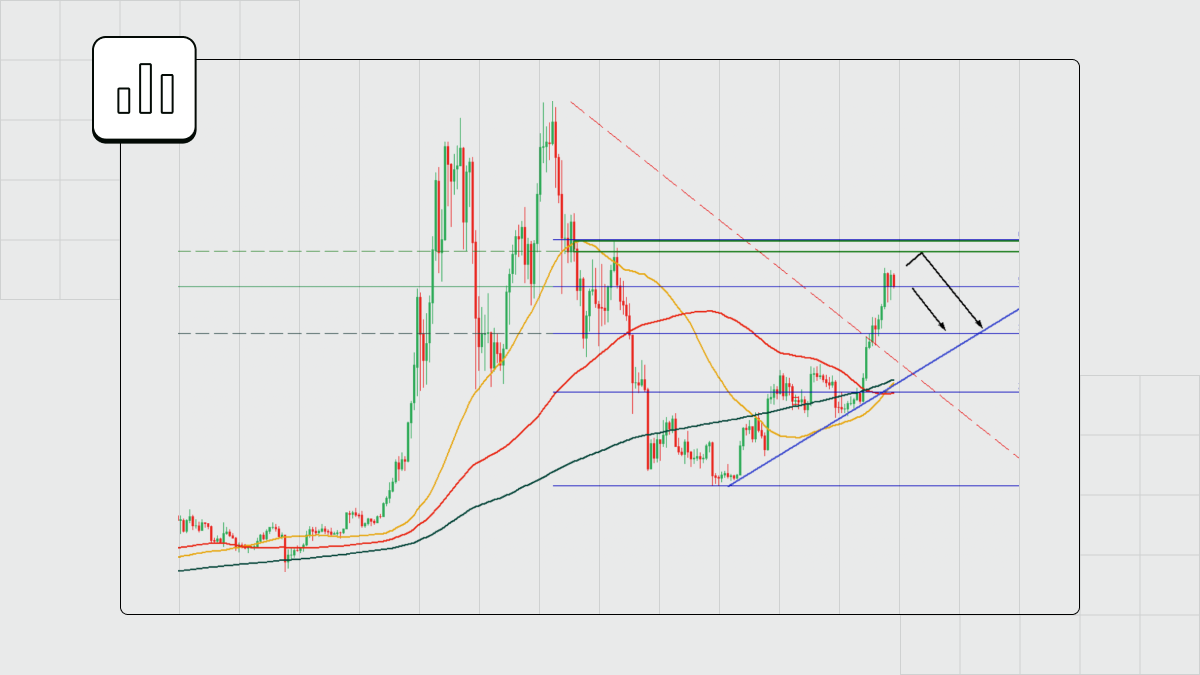

BTCUSD Weekly Chart – End of 2023

BTCUSD is currently on a significant uptrend, breaking through multiple resistance levels. According to Fibonacci retracement analysis, it is nearing a crucial resistance zone around $47,000, which aligns with the 61.8% Fibonacci level. Should the Federal Reserve decide to cut interest rates in response to an economic slowdown—a move similar to what was observed in 2019—there is a potential for a shift in investor sentiment, leading to a downturn in riskier assets like Bitcoin. In such a scenario, BTCUSD may reverse its course and move towards bearish territory, with a possible support level at $36,000.

At the same time, investing in BTCUSD for 2024 could be a strategic decision due to bitcoin's expected halving scheduled for this April, which has historically been a harbinger of market growth as seen in past cycles. Moreover, surveys show bullish sentiment among US investors, with a significant portion expecting Bitcoin to surpass previous all-time highs, potentially reaching $125,000 by the end of 2024.

Final thoughts

To sum up, looking for the best way to invest in 2024 requires a nuanced approach that combines caution with optimism. Navigating this landscape requires understanding global trends, regional nuances, and a strategic mix of short- and long-term investments. In the stock market, indices like the US500 and large-company stocks like Google remain attractive despite macroeconomic challenges. At the same time, alternative assets, including Bitcoin, offer additional prospects for diversified investments.

By aligning investment choices with personal risk preferences and staying abreast of these developments, investors can optimize their portfolios and take advantage of the coming year's potential.

FAQ

Where to invest money in 2024?

Cryptocurrencies, particularly bitcoin (BTC), are always considered the best place to invest money as they offer high-reward opportunities despite the risk they bring. The US500 index provides broad market exposure and diversification, representing the 500 largest U.S. companies from various sectors that have historically delivered consistent long-term growth. Oil and gas might also deserve attention due to geopolitical tension and its effect on the global economy.

Where should I put my money if I need it in 5 years?

Five years is not a very long investment period, so it is quite possible to consider not only high-risk assets, like cryptocurrencies and stocks but also less risky ones such as indices and bonds.

What is the safest investment with the highest return?

"Safe" is typically considered antonymous with "highest return." Typically, investors must decide between prioritizing safety or pursuing higher returns. US Treasuries (US bonds) and TIPS (inflation-protected bonds) are considered the safest options, while cryptocurrencies are often viewed as the most profitable.

How can I grow my money?

There is no one specific best way to grow your money. Apply several strategies to increase your chances of financial growth:

- Implement a systematic savings plan. By consistently setting aside a portion of your income, you can later use this money to invest in other opportunities when they arise.

- Invest in assets that align with your goals and risk tolerance. Seek the guidance of a trusted financial advisor like FBS. The broker’s market experts provide their traders with various educational resources online and guide them through trading intricacies.

- Consider career advancement or explore higher-paying job opportunities. For example, becoming an FBS introducing broker enables you to earn up to 43% of each of your client's trades.