Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-01-08 • Updated

These days may seem a little out of order to the oil price in light of the happenings between the US and Iran. This gives more reason to have a fresh look at the chart. But first, let us recollect the logic of the events.

On Friday, the news about the killed Iranian commander Soleimani reached the media. Markets were slow to react, then shocked, oil panicked.

On Sunday, the US President Donald Trump warned Iran against any retaliation; oil was still panicking.

On Monday, he said Iran never would have a nuclear weapon in reply to the surging note that the abandoned nuclear deal is the true background of the conflict; oil price was still falling down.

On Tuesday, Iran voiced out the coming retaliation; oil price kept falling.

Today, we hear that Iranian missiles hit the US airbases in Iraq; oil price panics again; President Trump reassures “all well” and says he would get back to us. Later during the day, we discover that none of the Americans or the Coalition forces were actually hit but the missiles. Moreover, we get reports that the retaliation strike was brilliantly managed by Iran to make sure it is big enough to satisfy the domestic vindictive mood among the Iranians but harmless enough to provoke the US to get back with a serious response.

No surprise, this flow of news forces the oil price to deviate from its’ “normal” trajectory. But does it actually?

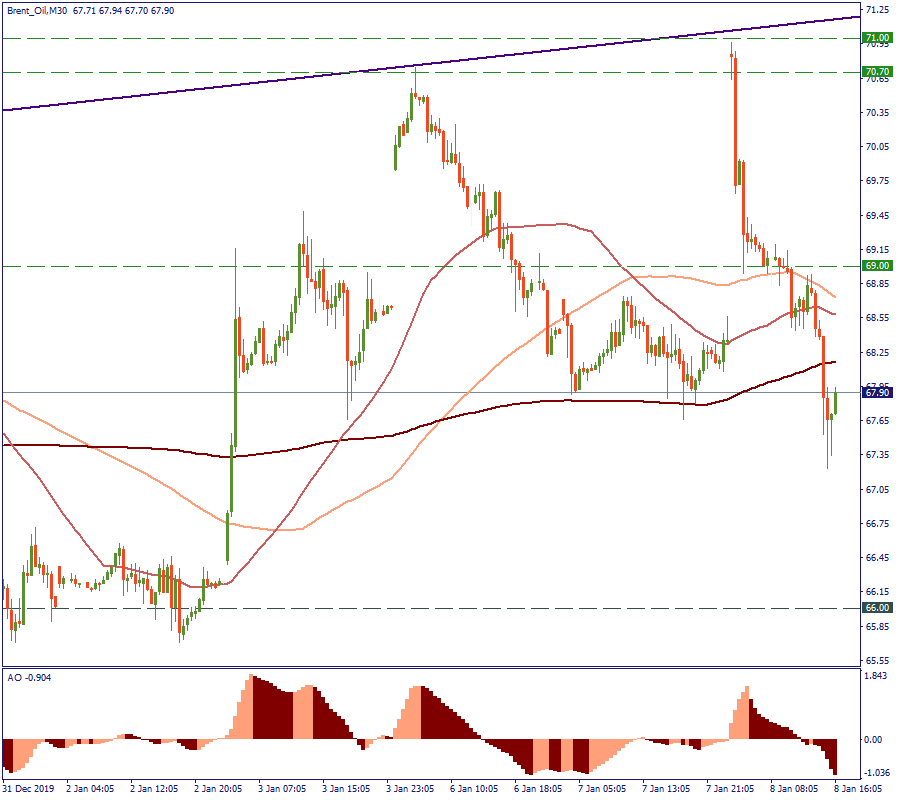

A short-term picture gives a shaky impression indeed. After the door of $70 per barrel on Monday, Brent secures this position today at $71, which is unseen since May 2019. But then, it falls down as if nothing happened and breaks through all short-term support levels along with the 50-period, 100-period, and 200-period MAs. Only the Awesome Oscillator consoles with a seemingly reached bottom.

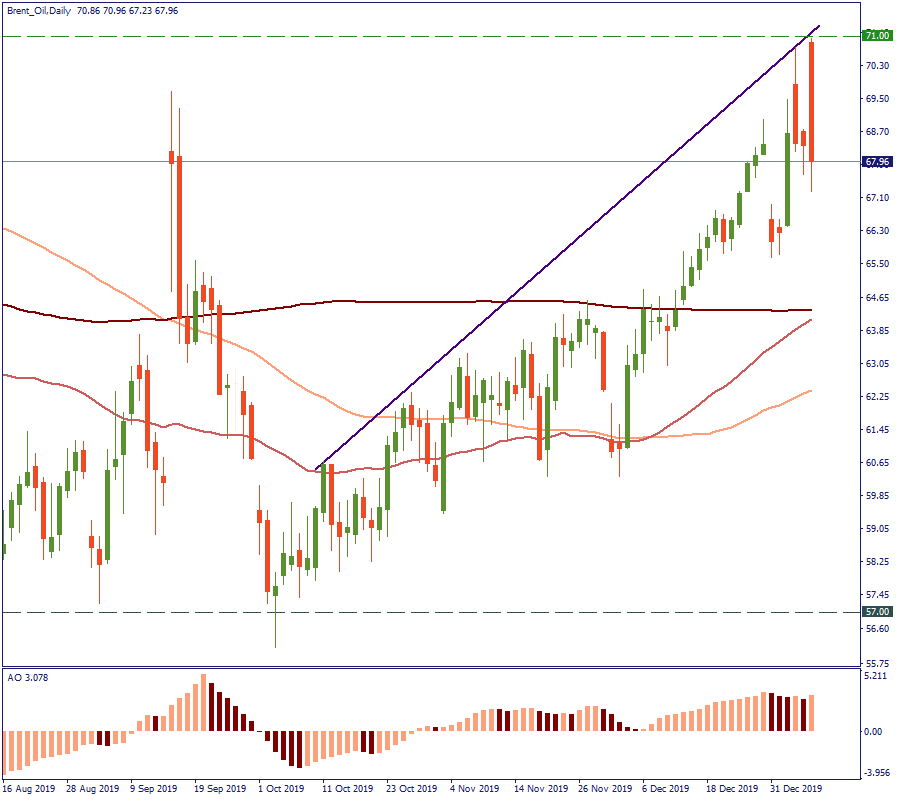

In the meantime, the long-term picture puts things in order. Yes, we see some “red volatility” at the end of the chart, but the trajectory did not deviate much from the general upward trend visible since October. Hence, even before the statement of the US President, we can have some certainty that the observed uptrend needs more to be challenged. Very likely, Brent oil price will secure its positions closer to the current level of $70 and then look for more strategic factors to follow.

The noise is the natural component of the market’s daily life. If you can trade the rumors, you have plenty of opportunities to do that, as these days have shown. Otherwise, make verified trade decisions, learn the techniques and follow the news.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!