EUR/USD 4H chart EUR/USD surged after Powell’s speech on Friday…

2020-12-21 • Updated

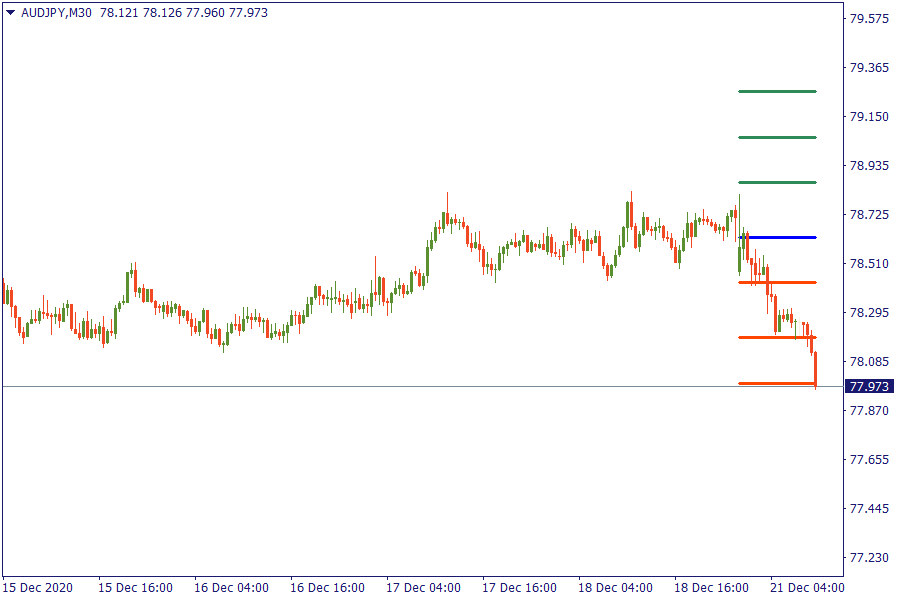

AUD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

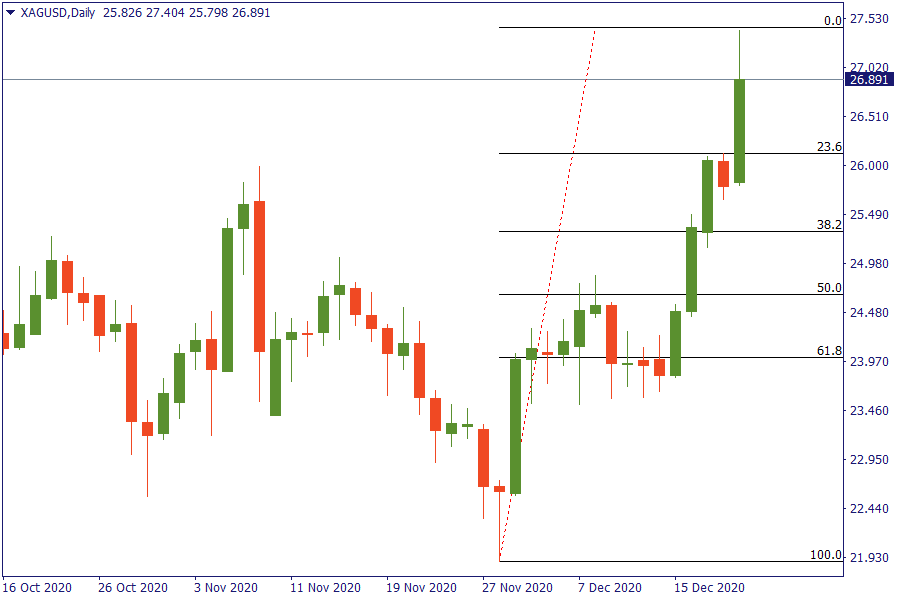

XAG/USD: Silver after a remarkable selloff over the last months is trading near the highs of the year.

EU Market View

Asia-Pacific equities traded mostly lower following a similar downbeat lead from Wall St; Mainland China outperformed.

Boris Johnson is holding emergency talks to avert Christmas food shortages after France banned freight and travel from the UK. The prime minister is chairing a crisis Cobra meeting of senior ministers and officials amid fears in Whitehall that some imported foodstuffs could run out in as little as two weeks. Johnson was forced into action after France and several other European countries responded to his Tier 4 COVID lockdown in southeast England by announcing a two-day travel ban from the UK. Germany, Italy, the Netherlands, Belgium, Austria, Ireland, and Bulgaria have all announced restrictions on UK travel after the PM revealed that a highly infectious new coronavirus strain has gripped the region.

US congressional leaders reached an agreement on Sunday on a $900 billion package to provide the first new aid in months to an economy and individuals battered by the surging coronavirus pandemic, with votes likely on Monday. The package would be the second-largest economic stimulus in US history, following a $2.3 trillion aid bill passed in March. It comes as the pandemic accelerates, infecting more than 214 000 people in the country each day. More than 317 000 Americans have already died.

EU Key Point

EUR/USD 4H chart EUR/USD surged after Powell’s speech on Friday…

Daily Chart 4H Chart Gold began the week higher breaking multiple resistance areas, including 1780 followed by 1800 and closed yesterday's trading above 1800 for the first time since the flash crash that happened few weeks ago…

Gold Daily Chart Throughout last week’s trading, gold traded within a tight range, but it also managed to hold well above its 1775 support area until the end of the week, while the technical indicators has improved over the past few days, including…

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!