The end of the last week was highlighted by the good news for the Brazilian market. The Brazilian president Jair Bolsonaro finally left the hospital on February 13 after the 17-day “power vacuum”. Now he is about to rule out one of the biggest issues in the Brazilian economy. Of course, we are talking about pension reform. Let’s find out what is so special about this reform and how it may affect the Brazilian currency.

Quick preview to the pension reform

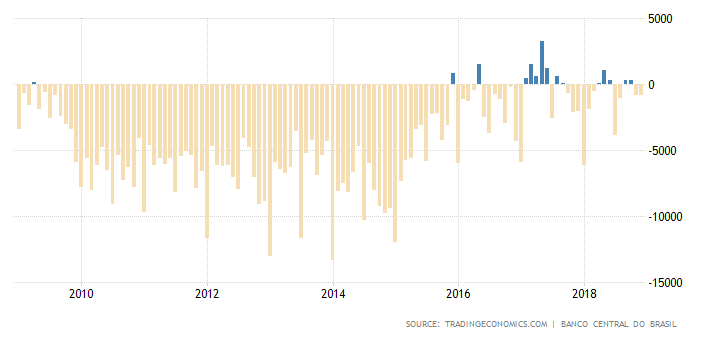

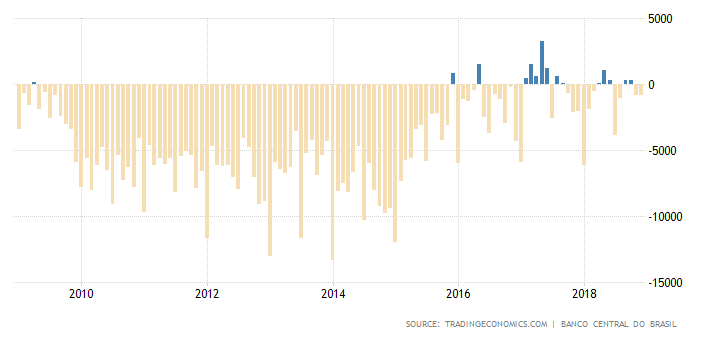

Can you imagine, that you can retire at 55 and earn 70% of your final salary for the rest of your life? Well, in Brazil it has been the normal situation for years. As a result, pension spending accounts for the third part of all government budget. It is easy to guess that this is the major reason for the huge budget deficit.

The “Operation Car Wash” investigation, which uncovered corruption at the highest levels of the Brazilian government started an era of changes in Brazil. The 2018 elections were the second significant step towards these changes. During the election campaign, the program by the far-right liberal Jair Bolsonaro got the most support by people and helped him to become the president of the country. Besides his statements on anti-corruption and gun ownership, he stressed the main point on the reformation of the pension system. It’s worth mentioning that the previous governments already tried to reform the pension system before, but faced resistance from public servants and other groups.

After the inauguration on January 1, the market started to wait for the further steps by the president.

At first, the president and the government economic team listed the main topics to be discussed in the future pension plan. These topics included a minimum age, transition period of the reform, size of pensions and social security debts. The first two of them were the hardest to reach an agreement on. The proposal by the economy minister Paulo Guedes suggested setting a minimum age of 65 for both men and women. However, president Jair Bolsonaro disagreed with the minimum age for women. He proposed for 60 years. As for the transition period, the president wanted it to last for 20 years, while the economic team suggested it to be twice shorter. These tensions inside the government increased the uncertainties around the final version of the reform. As a result, these uncertainties affected the Brazilian currency.

Finally on February 15, after the long-lasting discussions, the president and the government economic team finalized the pension system reform. According to this final version, the minimum retirement age will be 65 years for men and 62 years for women and the implementation of the reform will take 12 years. Now, the final word belongs to Congress. The Brazilian president will send the draft pension proposal on February 20. If Congress approves the reform, it will boost the Brazilian real. In case of any disagreements, the BRL will fall.

Now let’s look at the key levels for Brazilian real ahead of the important event.

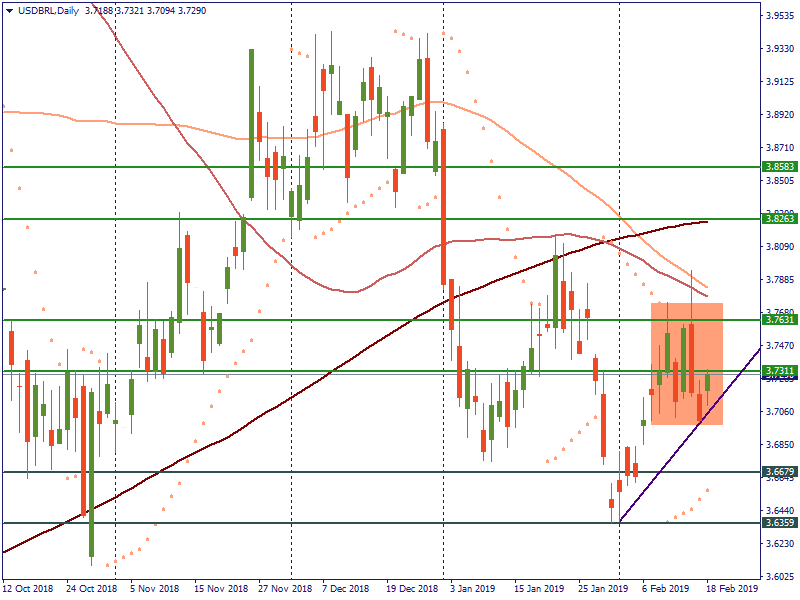

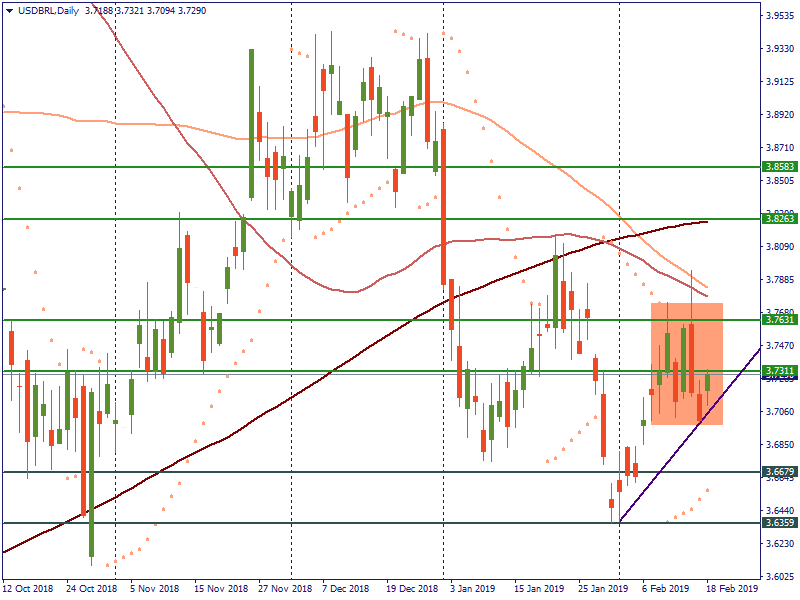

On the daily chart of USD/BRL, the pair has been trading sideways since the beginning of the last week. Despite the bearish pressure on February 14-15 after the approval of the reform, the trend for the pair is still bullish according to Parabolic SAR. If the pension reform proposal is welcomed by the Congress, the pair will fall towards the support at 3.6679. If bears are strong enough, they will pull the pair lower to the next support at 3.6359.

But let’s not forget about the economic events for the USD. February 20 is also the date of the FOMC meeting minutes’ release at 21:00 MT time. What if the Fed decides to provide hawkish hints on its monetary policy? In that case, we may expect USD/BRL to rise. For now, the pair is testing the resistance at 3.7311. If the USD strengthens or the pension reform is not approved, this level will be broken and the next resistance will be placed at 3.7631.

Conclusion

Since the election of Jair Bolsonaro as the new president of Brazil, the Brazilian real has been named as one of the strongest emerging market currencies. Let’s see how long the positive dynamics for the currency will last.