Survival of species

The law of natural evolution dictates that once a species is surpassed by a superior one that sustains itself on the same niche, the inferior one will now start contracting in size and is likely to perish - unless it finds another niche to live upon. As far away from animals as computers are, the laws of natural selection seem to care little as we see exactly the same picture in the kingdom of PCs.

A decade ago, the PCs were at the apex of production and sales. Now, it is a challenge for the PC industry to keep expanding: sales have been declining 7 years in a row, except for the Q4’2019. Mobile devices are leaving no chance behind for a number of reasons.

In this situation, it is unsurprising that HP has been facing problems with sales and is unlikely to get rid of this challenge. At the same time, it is still one of the five largest PC providers in the global market, enjoying 24% market share and being second only to the Chinese Lenovo.

Status: complicated

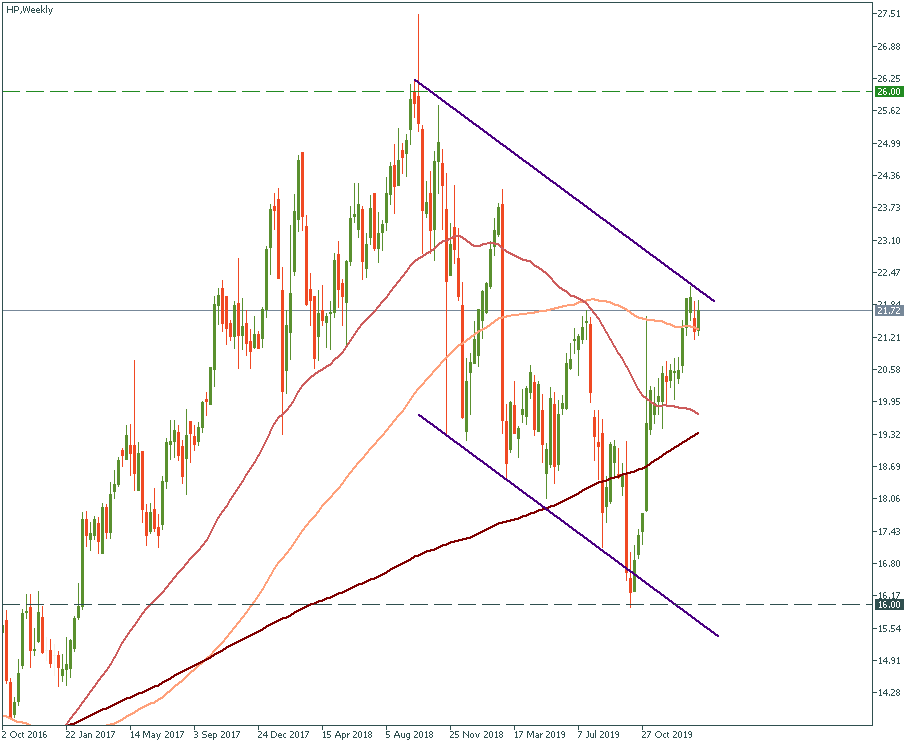

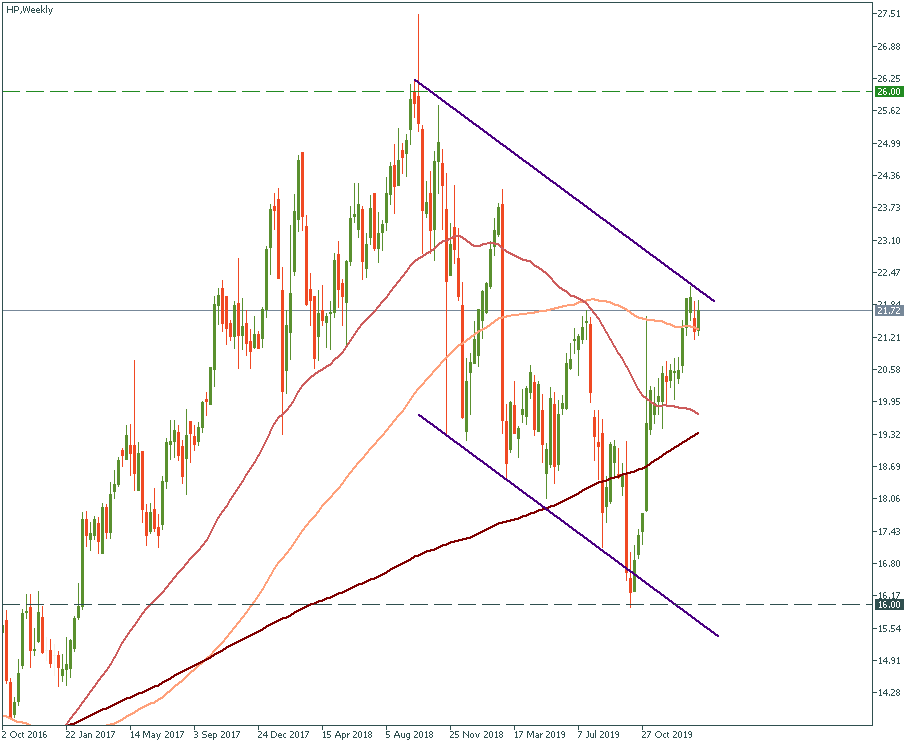

The weekly chart below shows the HP stock price performance, which gives mixed impression. First, for the sake of fairness, we have to note that the peak of $26 per share has been reached after a continuous two-years rise. Hence, on a large scale, the downtrend starting in September 2018 is a relatively recent change.

Second, exactly in view of the challenging state of the PC industry as a whole, it is already an achievement for HP not to go into a straight slump. A lot of observers predicted a decade ago that PC would see its death soon. If that was the case by now, we would probably see a different picture for this stock.

However, the tough reality is there. Mobile devices and laptops have taken a huge portion of previously loyal PC industry customers, while Lenovo doesn’t leave a chance for HP to take a breath in it’s own field. At the moment, gamers and businesses constitute the core of the focus audience for the company and the industry. It is unlikely that these customer categories shift to other types of devices in the nearest future. Being good news as such, it also means that this is where the horizon of HP sales ends. Therefore, the question for the company (as long as it stays within PC and printer product niche) is not whether it will be able to expand, but whether it will manage not to contract and stay afloat. Consequently, its stock faces the same question.

So what to do?

Wait and observe. Clearly, it is a very common recommendation, but it is often the best (and only) way to set your position with a particular stock. Look at the daily chart below. The price has recently reached $22.20, right at the upper border of the strategic downtrend, and now is in the local correction. Previously, the price has been actively rising since September 2019, when it took off at $16 per share.

Therefore, there are more reasons to think that in the mid-term it is likely to go down, probably to the area of $19 per share. Mainly, that’s because it failed to break through the resistance of $22.20 and because it’s movement up to that peak was significantly long. Hence, downside to $19 or sideways along $21 is more likely in the nearest future.

However, if the price goes up to surprise everyone, breaking $22 and further, it may be a trend-change indicator, hence we would need to re-group in this scenario, preparing for a bullish game. In any case, this stock is worth trying - LOG IN.