The Bank of Canada (BoC) is widely expected to leave its policy rate unchanged at 5% in its upcoming meeting, maintaining a hawkish stance in the face of rising inflation. The Canadian Dollar (CAD) has weakened against the US Dollar (USD) since the BoC's last rate hike in July, influenced by ongoing inflation concerns. Inflation in Canada fell to 3.8% in September from 4% in August, but the BoC remains uneasy about its persistently high levels. While some signs of a cooling housing market and stagnant economic activity exist, the BoC could signal future tightening due to its inflation worries.

EURCAD - D1 Timeframe

EURCAD is inching slowly towards the 76% of the Fibonacci retracement zone; which I usually consider to be a key level. The trendline resistance serves as a further confluence, as well as the 200-day moving average. This means that the scenario is likely to turn bearish in the next few hours.

Analyst’s Expectations:

Direction: Bearish

Target: 1.40528

Invalidation: 1.48306

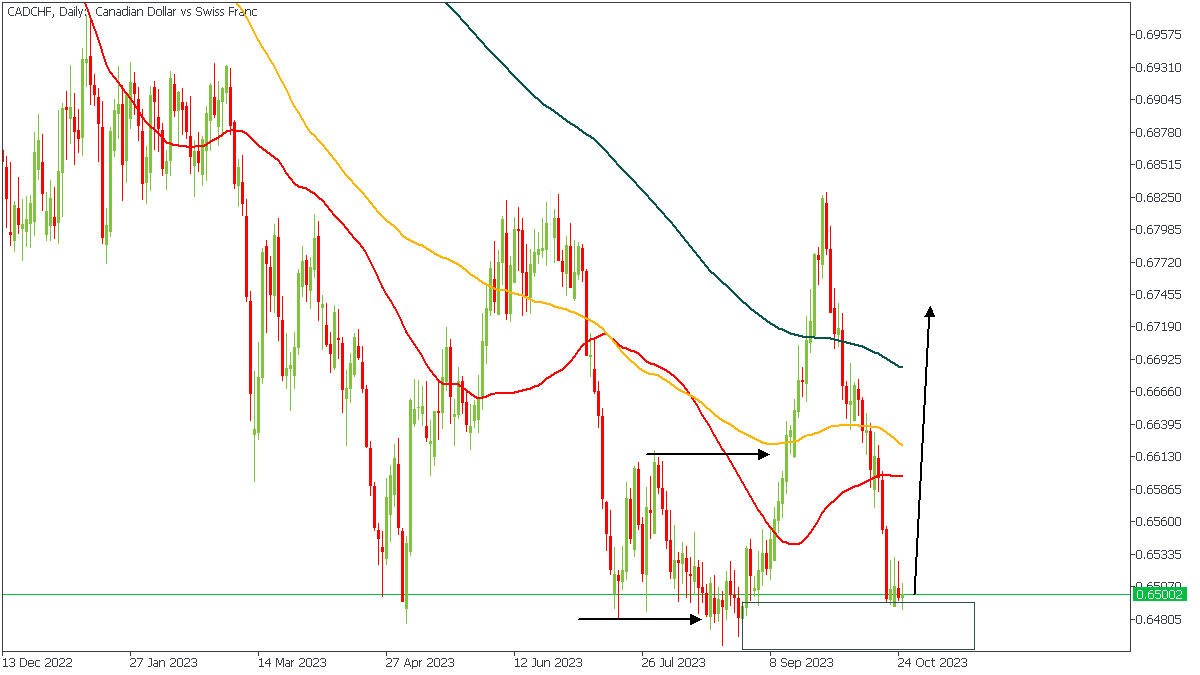

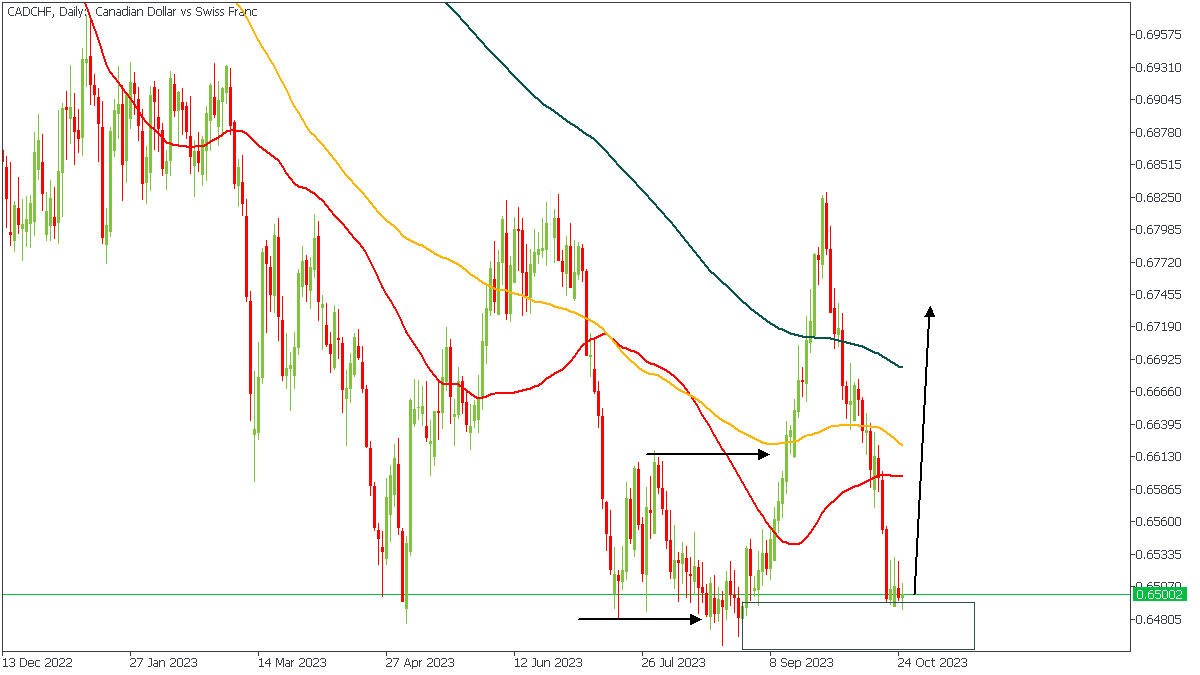

CADCHF - D1 Timeframe

CADCHF is currently creating a pattern that is largely similar to the inverted head-and-shoulder pattern. The current state of the market is a retest of the bottom - a demand zone, and we can expect to see a bullish pressure from that zine in the meantime.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66673

Invalidation: 0.64523

CADJPY - D1 Timeframe

CADJPY is currently resting on the 50-day moving average, and very close to the trendline support which can be considered a confluence. In my opinion however, I will be waiting to spot an entry from the 100-day moving average as the demand zone is considered to be a stronger confirmation since it is formed at the 76% of the Fibonacci retracement.

Analyst’s Expectations:

Direction: Bullish

Target: 110.402

Invalidation: 106.700

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more trade ideas and prompt market updates on the telegram channel.