The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2019-11-11 • Updated

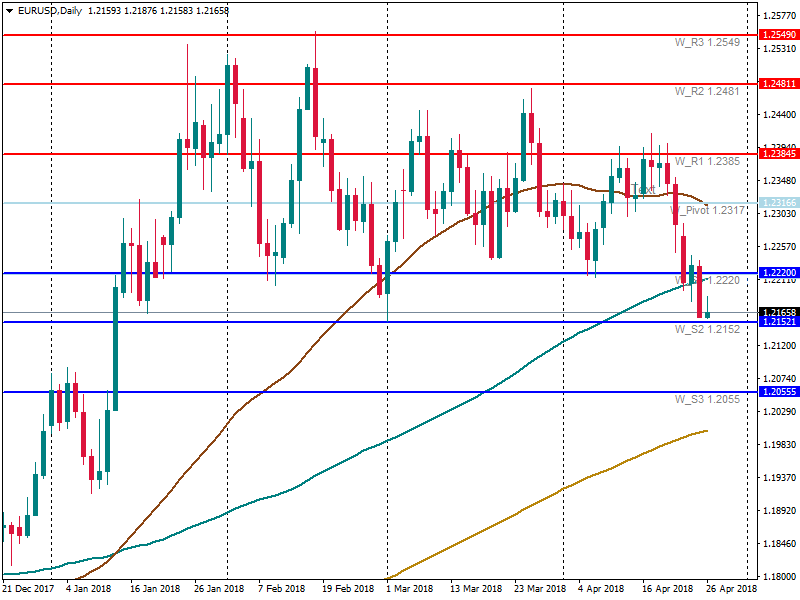

The euro has been plunging for a week and already reached its February lows. Traders are waiting for the ECB meeting (at 15:30 MT time on April 26) to get clues on its monetary policy. An increase of the interest rate is supposed to support the currency. However, the central bank cannot raise its interest rate until it ends the monetary stimulus. So, the agenda includes primarily the tapering of quantitative easing (QE). There are some factors that can cause more cautious comments of the ECB’s President Mario Draghi. The main question is whether negative economic data of the first quarter of 2018, geopolitical risks and March inflation data will affect the ECB’s outlook.

Let’s look at forecasts of the well-known financial institutions.

Analysts of Barclays, Citi and Morgan Stanly do not expect significant changes in the ECB’s monetary policy stance on April 26. However, Barclays considers a possibility of a more cautious sounding speech that will signal a very gradual approach to removing the QE.

Analysts of all 3 most authoritative financial institutes anticipate the QE tapering to end in the fourth quarter of 2018. Moreover, they agree that the June meeting will play a significant role in the QE issue. And then Draghi will give a clear answer on the QE tapering.

Although Barclays anticipates a little bit cautious speech that is not good for the single currency, an analyst at Commerzbank does not see it as a negative factor for the euro. According to Commerzbank, EUR doesn’t react much to changes in the monetary policy. That is why there is a low possibility of the euro’s great fall even if the monetary policy report will be slightly dovish. Moreover, the single currency is depreciating against the USD not because of its weakness but because of a rise of the USD.

Officials of the European Central Bank itself express contrasting opinions. For example, Executive Board member Mr. Mersch announced that inflation’s decline was weaker than predicted, but the head of the Lithuanian central bank Mr. Vasiliauskas said that it is time for transition from the ECB’s bond-buying program. Such comments only increase the intrigue for the market.

When you make your trades on Thursday, remember that the opinion of analysts is not the ultimate guidance for trading. The most certain thing about Thursday is that there will be a great volatility in the market: Mario Draghi knows how to make the euro move.

Although it is unlikely that the ECB will change its general stance at the meeting on April 26, a cautious sounding speech is likely as there are negative factors that can affect the ECB mood. To prepare for the exact trading, check technical analysis for EUR/USD.

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

The oil prices rally and world central banks’ dovish monetary policy caused by the Covid-19 pandemic were the main reasons for current inflation growth…

For the last several weeks gas was skyrocketing at an enormous pace. It has gained more than 17% from August 18. What is the reason for such moves?

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!