A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

2023-05-09 • Updated

A bull trap is a real pain in the neck as it causes substantial financial losses leaving the market participants penniless. The bull traps occur when prices start heading upwards, but then, out of nowhere, reverse and decline. This counter price move produces a trap and often leads to substantial sell-offs. You may face with such traps in a major resistance zone.

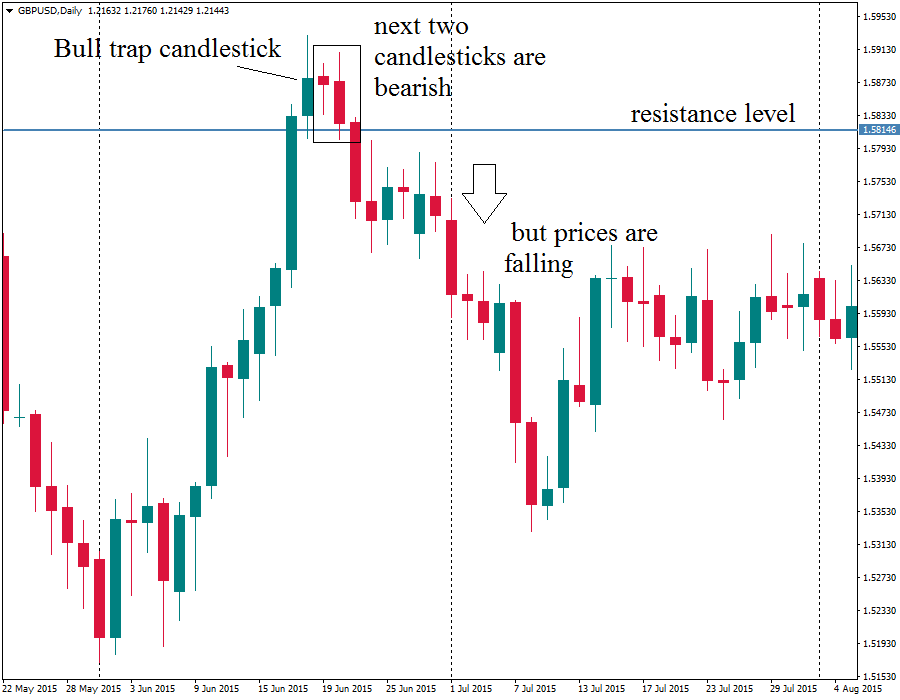

So, let us straighten out, how to predict the occurrence such traps; how to recognize them at the earliest stage of their formation. Here is how. Imagine, there is an uptrend; then, you notice the price running into resistance level and breaking it; it doesn’t stop there and continues to move higher. Then, a few candlesticks later, the rally phases out, and prices start falling. Those market participants who had open long positions (the bulls) as they notice a breakout of the resistance now feeling nervous as their stop losses are getting hit. So, they got trapped. Common bull trap chart pattern A bull candlestick breaks and closes above the resistance level, but the next 2 bars are bearish. The second candlestick in the pattern resembles a bearish pin bar type of candlestick.

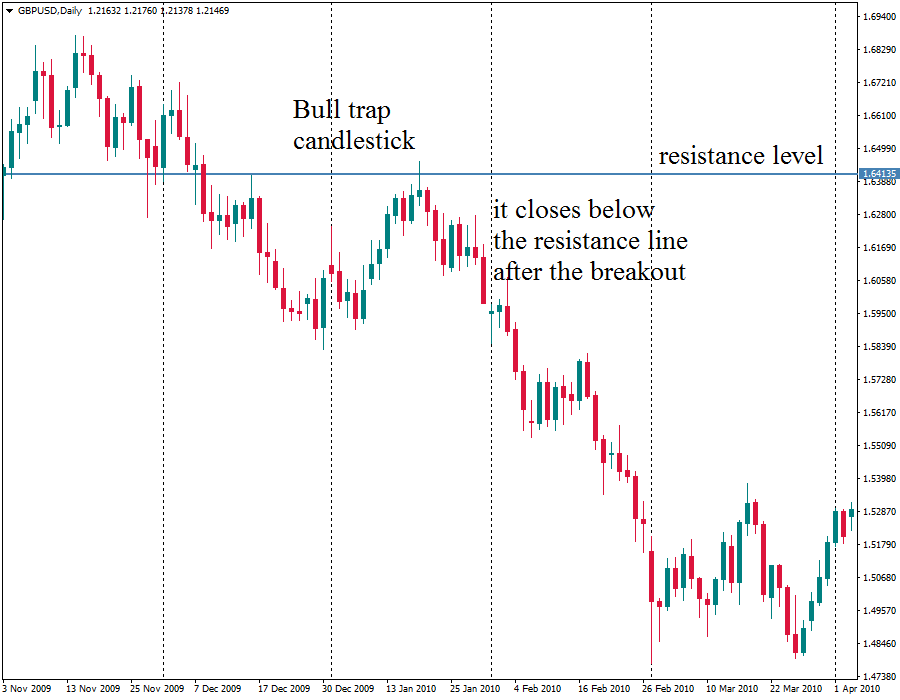

Another version of bull trap chart pattern A bull trap candlestick breaks the resistance and goes higher, but then closes below the resistance level forming a bearish candlestick.

Finding bull trap chart patterns as well as key resistance zones can be really difficult, especially for novice traders. Sometimes you can be deceived by the market. When you think that you found a bull trap, it will eventually turn out to be a true breakout to the upside. So, to find a strong resistance level you should switch to the weekly or the daily timeframes (any higher timeframes) and look at the charts. Is there a peak that actually stands out from the trading channel? If there is a peak, this is your resistance level (don't be too lazy to do this to confirm your resistance levels).

Trading Strategy

Now when you learned how to find the bull traps, we would like to suggest you several trading strategies.

"Key ingredients"

Currency pairs – any.

Timeframes – hourly charts are preferable, but you may use daily, H4 as well.

Background – learn to recognize bearish reversal candlesticks on multiple timeframes.

Technical tools – not required.

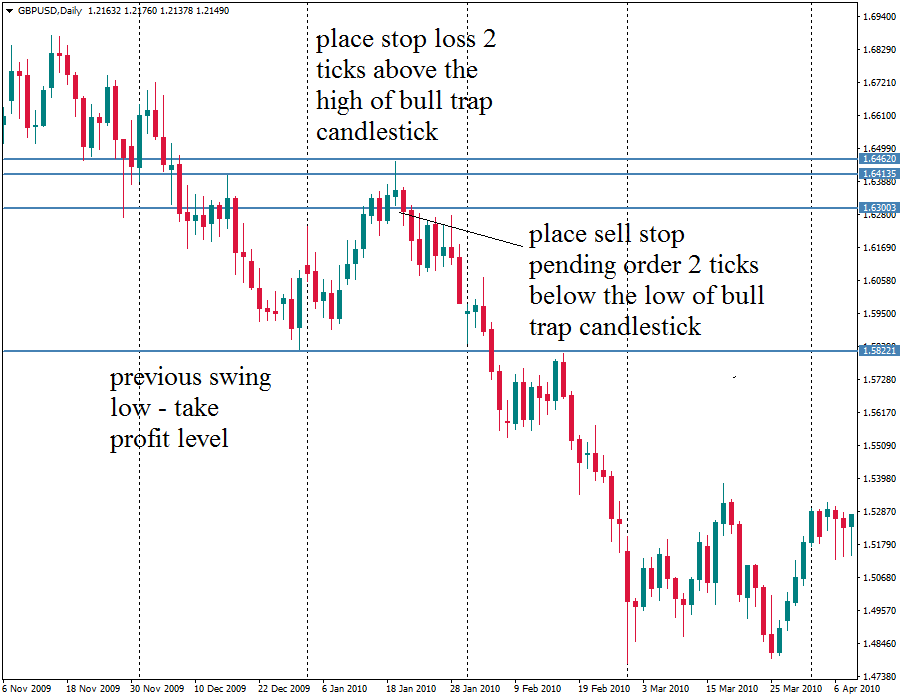

"Rules of the game" 1. When you see the price advancing to the resistance level, you should wait and see what happens when it reaches it; 2. After the price reached the resistance zone, and the formation of the bull trap chart pattern has started you may place a sell stop pending order at least 2 pips below the low of the candle that broke the resistance zone; 3. Then, place a stop loss at least 2 pips above the high of this candlestick; 4. Take profit should be placed at the previous swing low price level.

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

The Cypher pattern isn’t the most famous trading formation. Nevertheless, this trading instrument can help you better understand and forecast the price moves.

Have you ever wondered how many wonderful tools did Japanese people invent? QR codes, car navigation, instant noodles, and sushi are just some of the Japanese things we can't imagine our life without.

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!