Struggling to choose between part-time and full-time trading? Then this article is for you!

2023-04-03 • Updated

Today we are going to explain another strategy, which fits for the trading of majors. It is called multi majors strategy because you do not need to adapt it specifically to each pair. It works perfectly with them and provides you more signals compared to other strategies. Let’s consider what you need to implement to start taking advantage of this strategy. The strategy requires the usage of the following indicators:

• Heiken Ashi. Read about the indicator here.

• RSI with the period which equals 3.

• Stochastic indicator with the following settings: %K period=6, %D period=3 and Slowing=3

• Smoothed moving average with the 150 period.

You can implement the strategy while trading all of the majors and popular crosses on H4 or D1 timeframes.

The price should be placed above the smoothed moving average.

RSI leaves the oversold zone (crosses the 20 level from bottom to top).

One of the lines of the stochastic indicator leaves the oversold zone. Note, that the signals on both RSI and Stochastic indicator may not appear at the same time, as stochastic indicator usually comes later. You may take into account these signals as well. However, it is important for RSI not to enter the overbought zone when the signal on the stochastic appears.

The example below illustrates how to apply the strategy on practice.

On H4 timeframe of EUR/USD, the chart was placed above the smoothed moving average. Both RSI and Stochastic indicators left the oversold zone on January 9. We waited for the candlestick for the price to break the previous resistance and opened a position at 1.1943 (closing price of the green candlestick). We place our stop loss below the previous low at 1.1912. Our take profit is placed at the previous resistance level at 1.2070. As a result, with a risk of 31 pips, we earned 127.

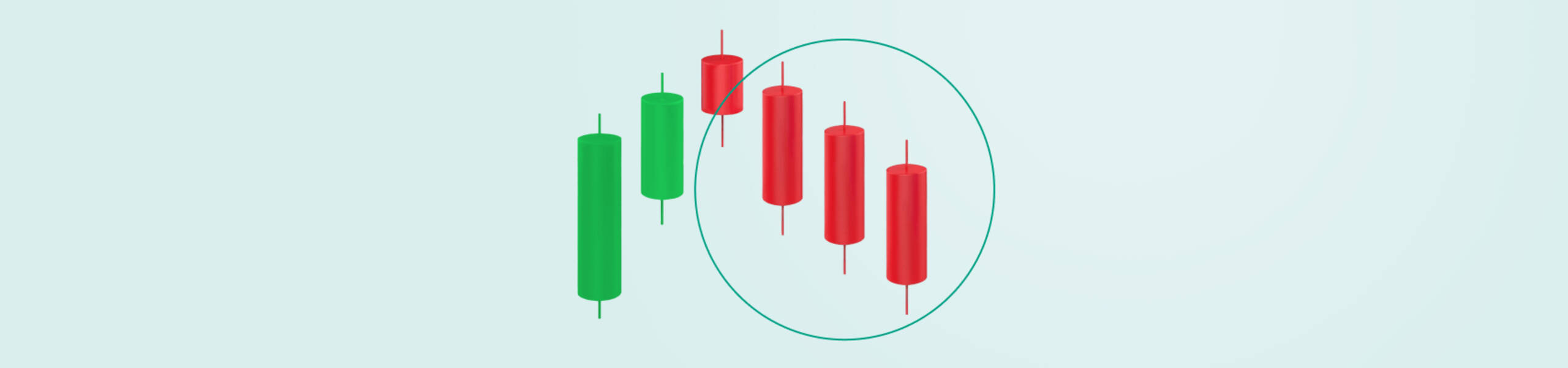

On H4 chart of EUR/USD, the price was moving below the smoothed moving average on July 31, 2018. After RSI and Stochastic oscillators crossed the overbought zone, we waited for the price to break below the previous support and opened a position at 1.1671. Our stop loss is placed above the previous resistance at 1.1718. Take profit is placed at the 1.1599 support level. Thus, we earned 72 pips with a risk of 47 pips.

Multi majors trading strategy helps you to trade more pairs without additional implementations. We can mention only one disadvantage of this strategy. This is the inability to adapt it to the specific features of a pair you trade.

Struggling to choose between part-time and full-time trading? Then this article is for you!

In trading, we can rely on a bunch of different entry signals.

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!