Increased worries about the no-deal Brexit pulled the pound down. GBP/USD reached lows of June 2017, the EUR/GBP pair rose to highs of October 2017. However, recently the situation at markets significantly changed. US-Turkey disputes escalated and the Turkish lira significantly plunged. Has all this affected the British pound? Yes!

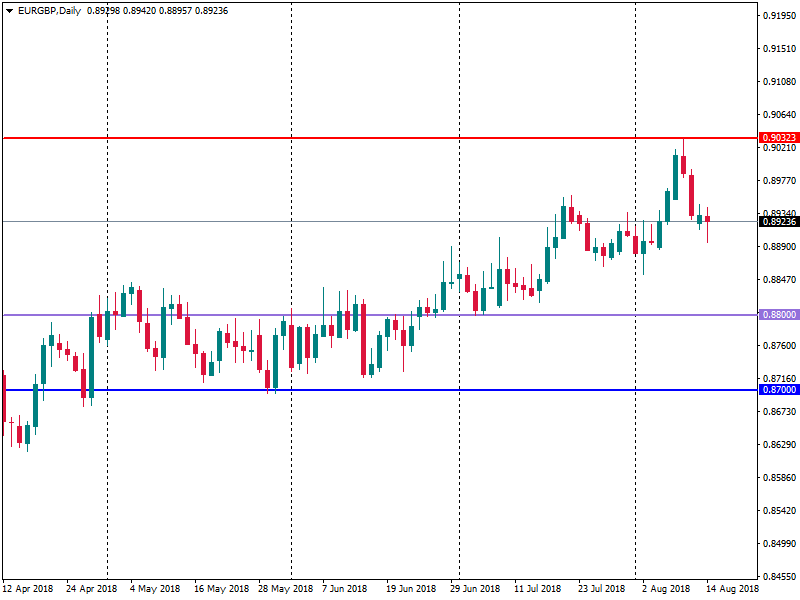

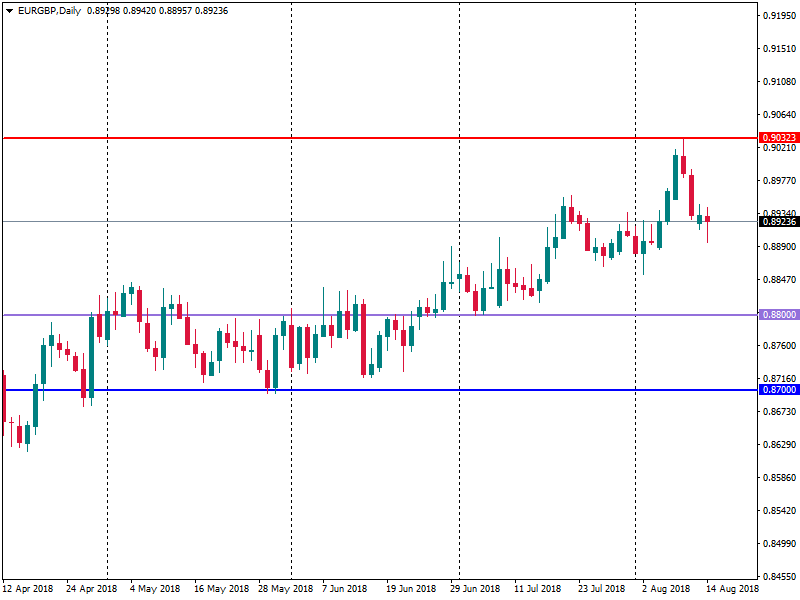

Let’s start with the EUR/GBP pair.

The great fall of the TRY affected the euro a lot. The European central bank is concerned about the TRY’s plunge as European banks are tied to Turkey. As a result, the escalation of the Turkish crisis will affect the Eurozone. Therefore, the GBP got a chance to recover against the EUR.

But is it enough to expect EUR/GBP fall? The fall of the Turkish lira and escalation of the US-Turkey disputes are near-term issues that will unlikely continue for long. Sooner or later the Turkish currency will become stable. Up to now, the Turkish lira has been already recovering. It means that risks for the euro are vanishing.

Let’s compare two currencies by interest rates. The Bank of England raised the interest rate in July. And the market is optimistic about the future rate hikes. At the same time, the European central bank remains cautious. It means that the market shouldn’t hope on the soon rate hike. In this case, the GBP is stronger than the EUR.

However, until the Brexit issue is solved, the British pound will remain under pressure. Experts can’t come to one forecast for the Brexit deal. Some of them believe that the EU and the UK will come to an agreement, some still have doubts that the parties will make a deal to March 2019. It means that the GBP will stay highly volatile.

As a result, we can say that the pound has chances to recover against the Euro. However, the Brexit deal will put pressure on the GBP.

According to Lloyds, in the medium-term EUR/GBP will keep trading within 0.87-0.9. At the end of the year, analysts see EUR/GBP at 0.88. But the end of 2019 will bring the pair to lows at 0.93.

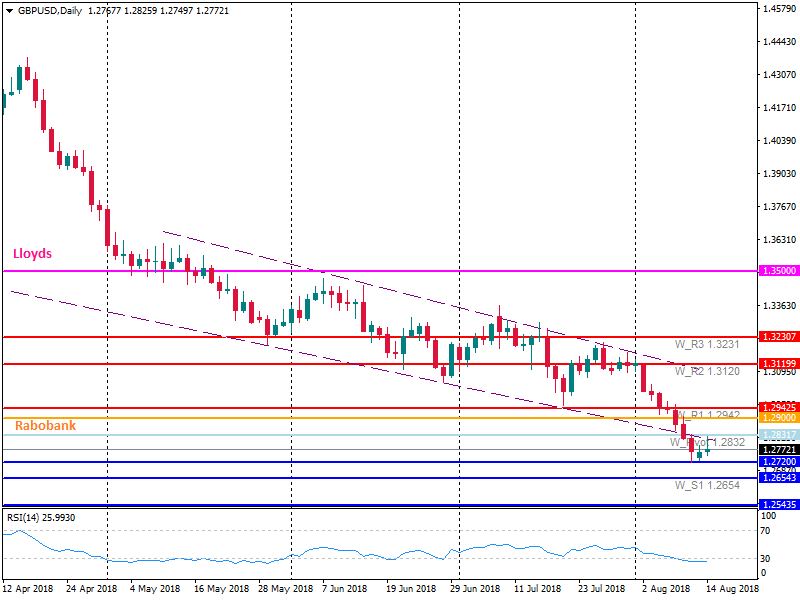

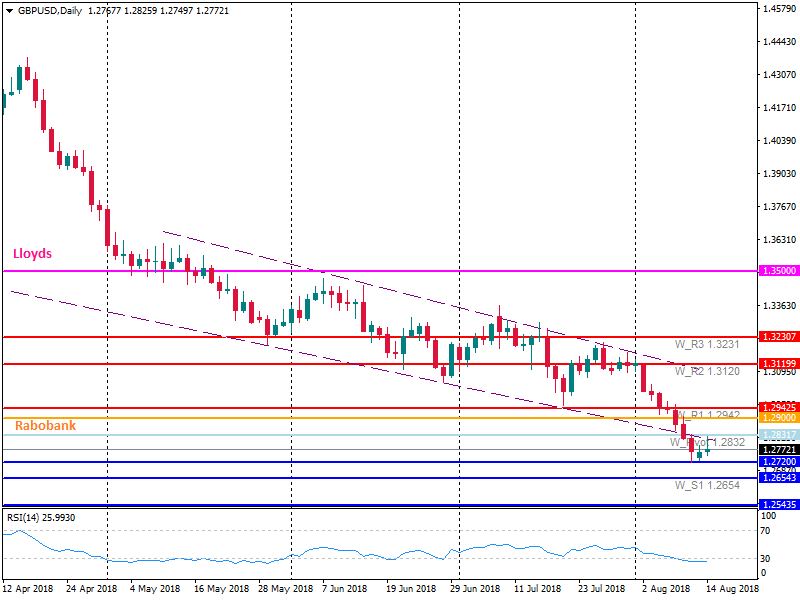

It makes sense to consider the GBP/USD pair.

There are no doubts that the US dollar is stronger than the GBP. However, the GBP/USD pair has been trading at significant lows for long and the reversal may happen soon. Let’s have a look at the technical side.

Up to now, the pound has been trying to recover. GBP/USD touched the support at 1.2720 and managed to rebound. But the strong USD doesn’t let the pair to rise further. However, according to the RSI indicator, the pair is oversold. It means that it’s time for traders to think about the long GBP at least in the short term. But what about the Brexit deal? Of course, it will continue affecting the GBP. However, it doesn’t mean that we can anticipate the reversal of the downtrend.

According to Lloyds, to the end of the year, GBP/USD will be at 1.35. In 2019 the pair will decline to 1.33.

However, there is another point of view. Rabobank sees GBP/USD around 1.29 in 12 months. In case of the unsuccessful Brexit deal, the fall to 1.12 is anticipated.

Making a conclusion, we can say that the pound has good chances to recover against the EUR and the USD. However, traders shouldn’t forget about the Brexit deal that will determine the direction of the pound.